Qualifying investors (any taxpayer) will invest in approved VCC's.

Welcome to Growth Tree

Welcome to Growth Tree

Qualifying investors (any taxpayer) will invest in approved VCC's.

The VCC will issue shares to you the investor and a 12J Tax certificate. The investor can then claim a tax deduction in respect of their investment in the approved VCC.

The VCC invests in qualifying investee companies.

In exchange, the 12J company will receive a return on investment from the investee company.

The terms “Section 12J” or “12J” are making reference to Section 12J of the South African Income Tax Act, 1962 (Act No. 58 of 1962).

Section 12J came into effect on the 1st July 2009 and was created specifically for the purpose of inviting investors to participate in the capitalisation of promising small and medium size qualified enterprises in the Republic of South Africa.

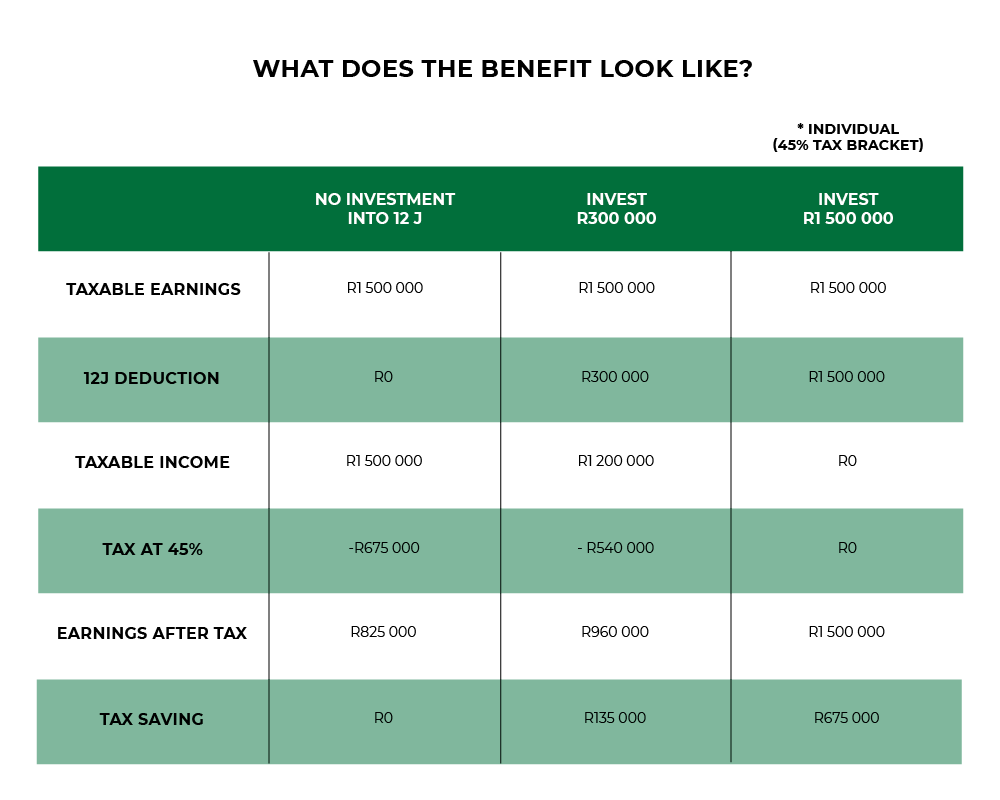

Taxpayers who invest in a Venture Capital Company (“VCC”), through the acquisition of shares in the VCC, in return are entitled to a 100% tax deduction of these monies invested, subject to the provisions of Section 12J, thereby achieving an immediate return on investment of up to 45% (being the reduction in taxes payable).

Venture capital is financing that investors provide to start-up companies and small businesses that are believed to have long-term growth potential. Venture capital generally comes from high net worth investors, investment banks and financial institutions. It is the acquiring of investment capital where the venture capital firm invests in a new start-up or fast-growing business that has the potential for significant returns. Small and medium and new start-up businesses are not large enough to access the global capital markets available to large, established corporations. Many of these businesses still need sizeable amounts of capital to scale their businesses into meaningful entities.

Here is a quick 4 point guide:

The VCC’s investment into the qualifying companies must be pure equity.

The company may not be seen as reasonably carrying on any trade in respect of the following:

An investor qualifies for a deduction equal to the amount invested in a 12J VCC, duly registered with the FSB and SARS, in the tax period the investment is made. The effective saving for the taxpayer is therefore the amount of the investment multiplied by his or her marginal tax rate.

In the tax period you wish to claim the deduction in, e.g. if your financial year end is 28 February 2021, you need to make the investment, and have the cash paid over, on or before 28 February 2021.

Yes. The performance of the fund will be directly linked to the performance of the investee companies. Risk will be mitigated through careful selection of investee companies, performance of due diligence investigations and the fact that a VCC may only invest up to 20% of capital raised in a single investee company, in essence forcing diversification.

Yes.